Press releases

Below you will find an overview of the latest press releases to inform the market and the public in the most accurate and transparent possible way.

Read our latest press releases

No results found

-

15 May 2025

A European first: Elia is testing a new system using UV spotlights to make overhead power lines more visible and thereby protect birds

System operator Elia has installed special ultraviolet (UV) spotlights on a highvoltage pylon along the Bruges-Slijkens overhead power line. -

08 April 2025

Enhancing synergies between the electricity and hydrogen sectors and new models to enable private capital

Copenhagen Infrastructure Partners (CIP), Elia Group and GASCADE launched the joined industrial paper “Green electricity and hydrogen”. -

08 April 2025

Transparency notification (erratum) – Atlas Infrastructure Partners

This press releases replaces the press release relating to the same topic dated 3 April 2025 at 7 pm (CEST). -

04 April 2025

93.81% of new shares subscribed at closing of the rights subscription period for holders of preferential rights

The sale of the scrips through a private placement to institutional investors starts today -

18 July 2024

Elia Group invests in SET Ventures to support digital innovation in the energy sector

Elia Group is investing €12.5 million in SET Fund IV, a €200 million international venture capital fund managed by SET Ventures. This capital will be invested progressively over the next 4 years in European start-ups that are developing digital technologies and services and are mature enough to be scaled up. -

05 June 2024

Elia Group SA/NV successfully places new €600 million seven-year bond

Elia Group SA/NV (“Elia Group”) has successfully placed a €600 million senior, unsecured bond, to be listed on the Euro MTF market. -

21 May 2024

Elia Group Annual General Meetings approve 2023 financial results and dividend payment

Elia Group today held an Ordinary General Meeting and an Extraordinary General Meeting. 71,39% and 71,29% of the shares were represented at the Ordinary General Meeting and Extraordinary General Meeting, respectively. Shareholders were able to attend the General Meetings in person or digitally. -

29 March 2024

Elexide wins Elia Group’s third hackathon aimed at unlocking flexibility through real-time pricing

Elia Group’s third hackathon, which centred on unlocking flexibility through real-time pricing, brought together participants from various sectors and backgrounds to tackle one of the energy sector's most important challenges: the unlocking of consumer flexibility. -

01 February 2024

Elia Group completes the acquisition of a minority stake in energyRe Giga

Further to the company announcement issued on 4 December 2023, Elia Group’s acquisition of a minority equity interest in energyRe Giga Projects (“energyRe Giga”) has been completed today on 1 February 2024. -

12 December 2023

Frédéric Dunon confirmed as CEO of Elia Transmission Belgium

As a shareholder in Elia Transmission Belgium, Elia Group can today announce that Frédéric Dunon has been confirmed as Chief Executive Officer of the Belgian system operator. -

08 December 2023

Elia Group presents its short- and medium-term financial targets during its Capital Markets Day

Elia Group is set to host its second Capital Markets Day on December 8, 2023, themed "Future Proofing Elia Group." -

06 December 2023

King Philippe and Queen Mathilde visit the 50Hertz (Elia Group) facilities in Berlin in the presence of the German President and First Lady

King Philippe and Queen Mathilde of Belgium visited the headquarters of 50Hertz, a German electricity transmission system operator and subsidiary of Belgian company Elia Group, as part of the Belgian state mission which is running from 5 to 7 December in Germany. -

24 November 2023

Quarterly statement: Elia Group Q3 2023

On Friday 24th November, the Elia Group published its interim statement for Q3 2023. -

16 November 2023

Elia and Statnett will investigate the economic and technical feasibility of a hybrid interconnector that will link Norway to Belgium

The grid operators Elia (Belgium) and Statnett (Norway) are investigating the feasibility of constructing a high-voltage direct current (HVDC) hybrid interconnector that would link Belgium and Norway to offshore windfarms. -

13 November 2023

Elia takes seven tangible measures to enhance biodiversity around the Princess Elisabeth Island

System operator Elia wants to boost biodiversity around the future energy island in the North Sea. -

03 October 2023

Environmental permit awarded for Princess Elisabeth Island, a key link in our future energy supply

Construction of the Belgian energy island will start early next year. North Sea Minister Vincent Van Quickenborne has approved the relevant environmental permit. -

07 September 2023

Catherine Vandenborre appointed as Chief Executive Officer Ad Interim of Elia Group

The Board of Directors met on 6 September 2023, at 6 p.m., in connection with the departure on 30 October 2023 of Chris Peeters, Chief Executive Officer of the Elia group. -

29 June 2023

Elia publishes its adequacy & flexibility study for Belgium for the period 2024-2034

Elia has published its fourth biennial study which focuses on Belgium's adequacy and flexibility needs for the coming decade (2024-2034). -

21 June 2023

Elia Group’s Extraordinary General Meeting approves amendment of the articles of association

Today, Elia Group held an additional Extraordinary General Meeting following the carens Extraordinary General Meeting it held on 16 May 2023. -

15 June 2023

Elia and Ecofirst share their experience in managing ecological corridors under high-voltage lines

On 14 and 15 June, electricity transmission system operator (TSO) Elia took part in a workshop organised by the European NGO RGI (Renewables Grid Initiative) on the development of ecological corridors under high-voltage lines. -

31 May 2023

Pioneering autonomous robot used to inspect ALEGrO’s HVDC converter station in Belgium

Last week an autonomous robot was installed in Elia’s main HVDC converter hall in Lixhe during the hall’s yearly outage period of one week. -

17 May 2023

Quarterly statement: Elia Group Q1 2023

On Wednesday 17th May, the Elia Group published its interim statement for Q1 2023. -

02 May 2023

Disclosure in accordance with section 15 of the Belgian Act of 2 May 2007

As a result of the implementation of the capital increase in favour of the members of the personnel of Elia Group NV/SA and its Belgian subsidiaries, as recorded in a notarial deed dated 26 April 2023, Elia Group NV/SA has issued 5,984 new shares. -

15 February 2023

Elia Group is one of 20 companies to join the new BEL®ESG stock market index

Elia Group is one of the Belgian companies selected to be part of BEL®ESG, the new stock market index directly linked to sustainability launched today by Euronext. -

14 February 2023

Elia and Amprion commit to close collaboration for second German-Belgian interconnector

The German transmission system operator Amprion and its Belgian counterpart, Elia, have signed a Memorandum of Understanding (MoU) relating to the construction of a second cross-border interconnector. -

31 January 2023

Nemo Link celebrates its fourth anniversary with exceptional operational performance, supporting security of supply in both the UK and Belgium

Nemo Link, the first electricity interconnector between the UK and Belgium, recorded exceptional performance in 2022. -

23 December 2022

Disclosure in accordance with section 15 of the Belgian Act of 2 May 2007

As a result of the implementation of the capital increase in favour of the members of the personnel of Elia Group NV/SA and its Belgian subsidiaries, as recorded in a notarial deed dated 13 December 2022, Elia Group NV/SA has issued 47.920 new shares. -

25 November 2022

Quarterly statement: Elia Group Q3 2022

On Friday 25th November, the Elia Group published its interim statement for Q3 2022. -

21 November 2022

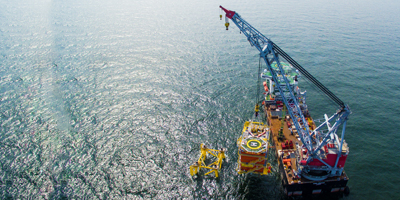

Prime Minister De Croo and Minister Van der Straeten visit the Baltic Eagle offshore platform in Hoboken

On Monday 21 November, Elia Group welcomed Belgian Prime Minister Alexander De Croo and the Belgian Federal Minister of Energy, Tinne Van der Straeten to visit the Baltic Eagle offshore transmission platform. -

19 October 2022

SELECT wins second Elia Group hackathon

The decentralisation of the electricity system requires more flexibility and innovative digital and customer-friendly solutions to manage the generation, transmission and consumption of electricity. -

03 October 2022

Elia presents its plans for an energy island, which will be called the Princess Elisabeth Island

In the presence of federal ministers Tinne Van der Straeten (Energy) and Vincent Van Quickenborne (North Sea), system operator Elia has presented its draft plans for what will be the world’s first artificial energy island. -

27 September 2022

A first in Belgium: Elia deploys drones to install bird diverters on its high-voltage lines

Today, Elia is installing bird diverters using drones – a first in Belgium. -

29 August 2022

The Greener Choice – A Joint Call for Action

Today, we stand together as ten European TSOs and confirm the ambitions we outlined in our first Greener Choice letter, in the hope of turning our vision into reality. -

29 June 2022

Disclosure in accordance with section 15 of the Belgian Act of 2 May 2007

As a result of its €590,113,068 rights issue, Elia Group NV/SA has issued 4,739,864 new shares, as recorded in a notarial deed dated 28 June 2022. -

21 June 2022

Elia Group’s Extraordinary General Meeting approves twofold capital increase to the benefit of staff

Today, Elia Group held an additional Extraordinary General Meeting following the Extraordinary General Meeting it held on 17 May 2022. -

15 June 2022

Elia Group SA launches a rights offering

Elia Group SA launches a rights offering (with extra-legal preferential rights for existing shareholders) of a maximum of 4,739,865 new shares, amounting to a maximum €590,113,192.50 -

10 June 2022

Sentrisense wins the Open Innovation Challenge with sensors that monitor the health of overhead lines using AI

BRUXELLES - BERLIN | Sentrisense, a start-up from Poland, has won Elia Group’s sixth Open Innovation Challenge (OIC). -

09 June 2022

Flow-based market coupling mechanism extended to all 13 countries of the Core capacity calculation region, furthering the energy transition

On 8 June 2022, the use of the flow-based market coupling mechanism was extended to cover the day-ahead timeframe across all 13 countries of the Core capacity calculation region (CCR), which includes Belgium and Germany. -

18 May 2022

Quarterly statement: Elia Group Q1 2022

On Wednesday 18th May, the Elia Group published its interim statement for Q1 2022. -

15 April 2022

Minister Dermagne visits the Arcadis Ost platform in Aalborg

On Thursday 14 April, Elia Group teams welcomed the Deputy Prime Minister and Minister of the Economy and Employment, Pierre-Yves Dermagne, to the construction site of the Arcadis Ost platform in Aalborg, Denmark. -

15 April 2022

Elia Group to convene Annual General Meeting and Extraordinary General Meeting

Today, Elia Group submitted a convocation notice to convene an Extraordinary General Meetings (EGM) at the same date of the General Assembly to be held on the 17th May 2022, and put a motion to the voting of the General Meeting to obtain authorised capital. -

11 April 2022

Elia donates electrical equipment to Ukrenergo to support Ukrainian high-voltage grid

At the request of the Ukrainian government, several European transmission system operators are sending electrical equipment to Ukraine. The Belgian system operator Elia is donating four generators and other equipment worth 200,000 euros. -

16 March 2022

Chris Peeters named Manager of the Year

BRUSSELS - The weekly business and finance magazine Trends has named Chris Peeters, CEO of Elia Group, as Manager of the Year 2021. -

22 February 2022

Elia Group expands its international offshore activities through its new subsidiary WindGrid

Elia Group's Board of Directors has approved the formation of a new subsidiary. Through WindGrid, Elia Group is ready to meet offshore development needs. -

11 February 2022

Elia Group’s sixth Open Innovation Challenge is focused on sustainability

The annual Open Innovation Challenge (OIC) allows Elia Group to maintain close ties with a broad ecosystem of start-ups and small and medium-sized enterprises (SMEs). -

05 January 2022

Federal government gives green light to the energy island

On Thursday 23 December, Belgian electricity transmission system operator Elia welcomed the federal Council of Minister's approval – further to a proposal made by the Ministers for Energy and the North Sea – of the planned extension of the modular offshore network to include the future Princess Elisabeth zone. -

21 December 2021

Elia Group CEO appointed as new chair of Roundtable for Europe's Energy Future (REEF)

Elia Group CEO Chris Peeters will become chair of the Roundtable for Europe's Energy Future in January 2022. -

26 November 2021

Quarterly statement: Elia Group Q3 2021

On Friday 26th November, the Elia Group published its interim statement for Q3 2021. -

25 November 2021

ALEGrO, the first interconnector between Belgium and Germany, celebrates its first anniversary and a year of good results

The first electricity interconnector between Belgium and Germany was commissioned a year ago (on 18 November 2020) by system operators Elia and Amprion. ALEGrO posted good results for its first year of operation: 93 % of availability and exchanges totalling 4.5 TWh. -

23 November 2021

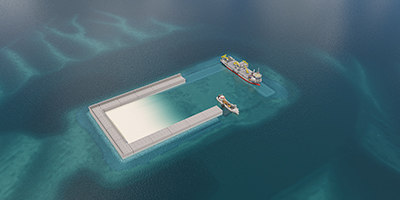

Elia and Energinet’s collaboration is advanced following preliminary study on hybrid interconnector between Belgium and Denmark

System operators Elia (Belgium) and Energinet (Denmark) are to continue collaborating on the implementation of what could become a world first: the first undersea connection between two artificial energy islands which will be able to exchange power between the two countries and at the same time transport electricity from offshore wind farms to the mainland. -

19 November 2021

Elia Group publishes “Roadmap to Net Zero”, our vision on building a climate-neutral European energy system by 2050

Tremendous efforts from across society are required to fight global warming. And yet, uncertainty remains about the necessary policies and the roadmap that can lead us to net zero. -

16 November 2021

Siemens Energy, Nemo Link, Ross Robotics and Elia Group collaborate over development of autonomous robots to optimise the inspection of HVDC converter halls

The use of such robots will improve asset inspections and maximise the operation of HVDC converter halls. -

09 November 2021

Flemish Minister-President Jan Jambon received at 50Hertz headquarters in Berlin for meeting with Flemish companies pioneering in offshore wind

BERLIN | Flemish Minister-President Jan Jambon visited the 50Hertz headquarters in Berlin during a working visit to Germany. -

03 November 2021

Elia Group (BE-GE) and Octopus Energy Group (UK) sign agreement to collaborate on consumer-centric energy flexibility services to facilitate the energy transition

Elia Group and Octopus Energy Group, two pioneering companies in the energy sector, have signed an MoU which reinforces their joint commitment to placing consumers at the heart of the energy transition. -

20 October 2021

German regulator sets return on equity for electricity and gas networks for the next regulatory period

BNetzA has published the future equity remuneration for all gas and electricity grid operators for the next regulatory period (electricity 2024-2028), at a pre-tax rate of 5.07%, post-tax 4.13%. -

18 October 2021

Green Bid wins Elia Group’s first ever hackathon on energy services for consumers with solution that allows prosumers to sell their excess solar energy

BRUSSELS -From 13 to 15 October, Elia Group hosted its first ever hackathon, which aimed to translate the Group’s vision on consumer centricity into tangible, practical solutions. -

30 August 2021

Elia Group tests long-range drones for inspecting power lines

A drone helicopter has been used for the first time for long-range inspections of power lines near Trois-Ponts. These BVLOS (beyond visual line of sight) drones may ultimately replace inspections using helicopters. -

19 August 2021

Elia Group and Malaysian electric utility company Tenaga renew cooperation agreement for exchange of best practice

Elia Group and Tenaga Nasional Berhad (TNB) are celebrating the signing of a second Memorandum of Understanding (MoU). -

29 July 2021

Elia Group enters into a liquidity agreement to support the liquidity of the Elia Group shares

Elia Group today announced it has entered into a liquidity agreement with Exane BNP Paribas providing the latter with the mandate to purchase and sale of Elia Group shares on the regulated market of Euronext Brussels. -

28 July 2021

Elia Group announces 2021 half-year financial results

Half-year results: Elia Group delivers on investments to further decarbonise society. -

12 July 2021

8 leading European transmission system operators launch a common initiative to support the energy system to reach carbon neutrality

They have published a joint paper that highlights the key enabling role TSOs are playing in the establishment of a climate-neutral society by 2050. -

22 June 2021

TideWise from Brazil wins Elia Group’s Open Innovation Challenge

TideWise is this year’s winner of the Open Innovation Challenge, a joint initiative organised by the Belgian and German transmission system operators Elia and 50Hertz. -

18 June 2021

Elia Group publishes white paper on a consumer-centric and sustainable electricity system, calling for collaboration and inviting allies to its first hackathon

BRUSSELS – BERLIN | “Towards a Consumer-Centric and Sustainable Electricity System” outlines Elia Group’s proposed market design for unleashing competition behind the meter. -

11 June 2021

Five finalists announced for Elia Group’s Open Innovation Challenge

The five finalists of the Open Innovation Challenge have been announced. The Open Innovation Challenge is a joint initiative organised by the Belgian and German transmission system operators Elia and 50Hertz. -

04 June 2021

Elia Group presents its sustainability action plan: ACT NOW

In recent years, sustainability has become a core part of Elia Group's strategy. Our ACT NOW plan defines concrete and measurable objectives which outline how we will embed sustainability into our business processes in the years ahead. -

19 May 2021

Quarterly statement: Elia Group Q1 2021

Elia Group remains confident with regard to realising an Adjusted Return on Equity (ROE adj.1) of between 5.5% and 6.5% for 2021. -

18 May 2021

Elia Group Annual General Meeting approves 2020 financial results and dividend payout

Today, Elia Group held its Ordinary and Special Annual General Meetings, during which the shareholders approved all of the proposed items which were discussed in line with the meeting agendas. -

14 May 2021

Thirty companies selected for second round of tests in IO.Energy ecosystem to work on new energy services

Some 30 companies from various industries will test out new energy services as part of the Internet of Energy (IO.Energy). -

02 April 2021

Elia Group launches enhanced Inside Information Platform, reinforcing its commitment to transparency

Elia Group has launched an enhanced Inside Information Platform which provides data visualisations representing the unavailability of electricity facilities owned by its system operator companies Elia (in Belgium) and 50Hertz (in Germany) -

31 March 2021

Elia Group’s incubator sparks digital innovation

The Nest, Elia Group’s incubator, is encouraging staff to become digital innovators. -

29 March 2021

Using drones and AI to inspect Elia's high-voltage pylons

Drones will soon be helping us make sure the lights stay on in Belgium. They will be used to inspect high-voltage pylons. -

18 March 2021

Disclosure in accordance with section 15 of the Belgian Act of 2 May 2007

As a result of the implementation of the capital increase in favour of the members of the personnel of Elia Group NV/SA and its Belgian subsidiaries, as recorded in a notarial deed dated 18 March 2021, Elia Group NV/SA has issued 7,360 new shares. -

10 March 2021

Elia Group to rejoin BEL 20

Elia Group will rejoin the BEL 20 index on 22 March 2021. The company has been listed on Euronext Brussels since 2005 and was previously included in the BEL 20 between March 2012 and March 2017. -

10 March 2021

Speeding up progress on the energy transition: 50Hertz increases investments in infrastructure

For transmission system operator 50Hertz, a decisive decade in terms of the energy transition is beginning. By 2025, the company wants to invest almost twice as much in its grid infrastructure than it has over the past five years. -

03 March 2021

Elia Group announces results for the 12 month period ending 31 December 2020

Full year results

Elia Group makes crucial investments for energy transition while delivering strong financial results.

-

24 February 2021

BESIX, the construction company, and Elia, the grid operator, want to give smart buildings an active role in the electricity system

To achieve a climate-neutral society by 2050 as outlined in the European Green Deal, more than just an energy transition is needed. -

12 February 2021

Elia and Energinet launch feasibility study for hybrid interconnector between Belgium and Denmark

System operators Elia (Belgium) and Energinet (Denmark) have set up a working group to examine the feasibility of a subsea cable between Belgium and Denmark that would link the high-voltage grids of both countries over a distance of more than 600 km. -

03 February 2021

Two years of outstanding operational performance for Nemo Link, the UK-Belgium interconnector

Nemo Link, the first electricity interconnector between the United Kingdom and Belgium, has performed very well during its first two years in operation. -

19 January 2021

Elia Group awarded 2020 BelMid Company of the Year

Elia Group receives the BelMid Company of the Year 2020 award during Euronext annual New Year’s Ceremony. The company receives this award because it has demonstrated the highest relative increase in market capitalization last year. Since 2005 Elia Group is listed on Euronext Brussels. -

14 January 2021

Elia Group’s fifth Open Innovation Challenge focuses on innovative solutions for offshore wind applications

Elia Group, a European Group of transmission system operators active in Belgium (Elia) and northeast Germany (50Hertz), is set to launch its fifth Open Innovation Challenge. -

22 December 2020

Disclosure in accordance with section 15 of the Belgian Act of 2 May 2007

As a result of the implementation of the capital increase in favour of the members of the personnel of Elia Group NV/SA and its Belgian subsidiaries, as recorded in a notarial deed dated 22 December 2020, Elia Group NV/SA has issued 67,757 new shares. -

18 December 2020

10 leading TSOs launch joint initiative to reduce GHG emissions

This GHG reduction effort will tackle their own carbon footprint while also addressing much greater opportunities at system level, driven by electrification and the integration of renewable electricity sources (RES). The joint initiative is supported by Amprion (DEU), APG (AUT), Elia Group (BE & DEU), Red Eléctrica (ES), RTE (FR), Swissgrid (CH), Tennet (NL & DEU) and Terna (IT). -

27 November 2020

Elia Group calls on suppliers to work on sustainability

Together with 6 other European Transmission System Operators (TSOs), Elia Group calls on its suppliers to offer their products or services in a sustainable way. The call for a greener choice has been launched in an open letter. Suppliers are encouraged to contribute to a more sustainable and carbon-neutral society. -

25 November 2020

Quarterly statement: Elia Group Q3

On Wednesday 25th November, the Elia Group published its interim statement for Q3 2020. -

16 November 2020

Coalition of NGOs, wind industry and TSOs pledge to work together for a sustainable offshore energy development

A Coalition of NGOs, wind industry and transmission system operators has joined forces today to cooperate on the sustainable deployment of offshore wind, while ensuring alignment with nature protection and healthy marine ecosystems. 18 organisations from across Europe have signed a Memorandum of Understanding and committed themselves to working together. -

09 November 2020

Elia and Amprion launch ALEGrO, the first interconnector between Belgium and Germany

On Monday 9 November, system operators Elia and Amprion inaugurated the first electricity interconnector between Belgium and Germany. -

20 October 2020

Combined Grid Solution, the world's first hybrid interconnector, inaugurated today by 50Hertz in the Baltic Sea

On 20 October, German TSO 50Hertz (Elia Group) and Danish TSO Energinet inaugurated Combined Grid Solution (CGS), the world's first hybrid offshore interconnector. -

13 October 2020

Elia Group launches re.alto, its own corporate start-up to accelerate digitalisation of the energy sector

Elia Group has today officially announced re.alto, its first corporate start-up company. The re.alto marketplace brings together providers and users from all sides of the energy economy. -

09 October 2020

IO.Energy ecosystem enters its second phase and plans to test new energy services

The first sandboxing phase of the Internet of Energy (IO.Energy) project came to an end on Friday 9 October and was marked by an event attended by Thomas Dermine, the new State Secretary for Scientific Policy, Recovery and Strategic Investments. -

16 September 2020

ALEGrO: last junction completed

The Walloon Ministers for Energy, Philippe Henry, and Spatial Planning, Willy Borsus, attended the completion of work on the ALEGrO project this Wednesday at the Lixhe converter station in Liège Province. -

11 September 2020

Heptasense from Portugal wins Elia Group innovation competition

Heptasense is the fourth winner of the Open Innovation Challenge, an initiative by the Belgian system operator Elia and its German sister company 50Hertz. -

07 September 2020

Historic piece of Berlin Wall at Elia site highlights link between Berlin and Brussels within Elia Group.

Former President of the European Council and Prime Minister of Belgium, Herman Van Rompuy, together with the German Ambassador, Martin Kotthaus, and other dignitaries have unveiled a fragment of the Berlin Wall at Elia's site in Schaerbeek. -

29 July 2020

Elia Group 2020 announces Half-year financial results

Half-year results: Elia Group shows operational continuity in extraordinary times. -

03 July 2020

Five Elia Group innovation competition finalists announced

Five finalists from different parts of the world are still in the running for the fourth Open Innovation Challenge. The contest is a joint initiative by Belgian system operator Elia and its German sister company 50Hertz. The Open Innovation Challenge helps Elia Group to innovate in highly specific areas of its work as a system operator by engaging in joint projects with start-ups. -

20 May 2020

Quarterly statement: Elia Group Q1 2020

On Wednesday 20th May, the Elia Group published its interim statement for Q1 2020. -

19 May 2020

Elia Group Annual General Meeting approves 2019 financial results and dividend pay-out

Elia Group today held its Ordinary and Extraordinary General Meetings, at which shareholders approved all agenda items. -

07 May 2020

Debut Green Bond of EUR 750 million successfully issued

Eurogrid GmbH, the parent company of the German transmission system operator 50Hertz, is securing liquidity for the further grid expansion necessary for the energy transition with the issuance of its debut Green Bond of EUR 750 million. -

22 April 2020

Power Transmission System Operators are working full speed and across borders to keep the light on in Europe and to restart an ever greener economy

The Electricity Transmission System Operators of Austria, Belgium, France, Germany, Italy, Netherlands, Spain and Switzerland are regularly coordinating their efforts to do the utmost to limit the consequences of the Covid-19 pandemic on people, electricity supply and the economy in Europe. -

17 April 2020

Special arrangements for the Elia Group general meetings on 19 May 2020

Exceptionally, shareholders and bondholders will not be able to physically attend the ordinary and extraordinary general meetings of Elia Group on 19 May 2020. -

06 March 2020

Elia Group (Euronext: ELI) announces results for the 12 month period ending 31 December 2019.

Full Year Results:

Elia Group realised its ambitious investment program, achieved strong operational and financial results and is ready to realise the next phase of the energy transition bringing maximum welfare to society. -

04 February 2020

First ever power cable between UK and Belgium celebrates strong performance in its first full year of operation

Nemo Link, the first ever power cable between the UK and Belgium, has today reported outstanding performance figures as it celebrates its first full year of operation. -

27 January 2020

2020 Open Innovation Challenge focuses on digitalisation for enhanced security

Elia Group, a transmission system operator active in Belgium and northeast Germany, is set to launch its fourth Open Innovation Challenge this month. The competition invites start-ups from around the world to present solutions to any of the many challenges system operators face. -

20 January 2020

Designation of Elia Transmission Belgium as national and regional/local TSO and change of name of Elia System Operator to Elia Group.

Following the completion by the group Elia of its internal reorganisation on 31st December 2019, Elia Transmission Belgium has been designated as the national and regional/local Transmission System Operator (TSO) for the very high- and high-voltage electricity grid in Belgium. In addition, Elia System Operator will be renamed Elia Group SA/NV. -

31 December 2019

Completion of the internal reorganisation of the Elia Group

Just before midnight today, Elia will have effectively implemented its internal reorganisation, the aim of which is to isolate and ring-fence the regulated activities of Elia in Belgium from the non-regulated activities and regulated activities outside Belgium. -

12 December 2019

Elia and 50Hertz publish a joint study on futureproofing the EU energy system towards 2030

From the perspective of two system operators (Elia in Belgium and 50Hertz in Germany), Elia Group wants to raise awareness about the increasing challenges on both the grid infrastructure (hardware) and the market design (software) of the European interconnected electricity system. The joint study ‘Future-proofing the EU Energy System towards 2030’ proposes two levers to realise the next phase of the energy transition in a timely and efficient way with maximum welfare for society. -

03 December 2019

Stefan Kapferer in office as new 50Hertz-CEO

The German Transmission System Operator (TSO) 50Hertz now has a new chairman of the executive board. Stefan Kapferer is in office since December 1st. Up until the end of October Kapferer was head of BDEW, the German Association of Energy and Water Industries. -

29 November 2019

Quarterly Statement: Elia Group Q3 2019

On Friday 29 November, the Elia Group published its interim statement for Q3 2019. -

28 November 2019

European Single Intraday Coupling (SIDC) Parties confirm successful XBID 2nd wave go-live.

European Single Intraday Coupling Parties (SIDC - formerly known as XBID) confirm successful 2nd wave go-live. Significant increases in traded volumes is reported across the seven countries who joined the SIDC coupling last week. -

08 November 2019

Shareholders’ Meeting approves reorganisation Elia Group

Elia held its Extraordinary Shareholders’ Meeting on 08/11/2019. All items on the agenda have been approved. -

08 November 2019

XBID Wave 2 Go-Live announced for 19th of November 2019

European Single Intraday Coupling (SIDC) Solution (formerly known as XBID) and Local Implementation Projects confirm 2nd wave go-live date for November 2019. Seven further countries to be coupled with the fourteen already operational. -

07 November 2019

CREG approves Elia's electricity transmission tariffs for the 2020-2023 regulatory period, leading to an average decrease of 2.1% in 2020

CREG's Management Committee has approved Elia's revised tariff proposal for the 2020-2023 regulatory period. -

25 October 2019

Elia Group appoints Michael von Roeder as Chief Digital Officer

Elia Group is pleased to announce that Michael von Roeder will join the company as of 1 November 2019 as Chief Digital Officer (CDO). He will lead our digital transformation program and take over the leadership of the Elia Group IT and Digital departments. As CDO, Michael von Roeder will be a member of the Elia Group Committee (EGC). -

02 October 2019

Board approves new company structure of Elia Group

The Board of Directors of Elia System Operator approved the new corporate structure of Elia Group. The decision was taken following the fulfilment of certain preconditions, which included regulatory approval and confirmation of the compliance with the Belgian Electricity Law. As a result, an extraordinary shareholders’ meeting will be convened on 8 November 2019. -

10 September 2019

King Philippe visits first ‘power hub’ in the North Sea

His Majesty the King of the Belgians today visited the Modular Offshore Grid (MOG), Elia's first power hub in the North Sea. -

26 July 2019

Half-year results: Strengthening and expanding the grid while delivering a solid financial performance.

Normalised Net profit up 8.2% to €154.4 million as a result of the timely realisation of investments and solid operational performance. -

28 June 2019

Adequacy and flexibility study for Belgium 2020-2030

Elia envisages increasing capacity shortage to cope with the nuclear exit in Belgium; new report indicates the urgency of the situation and the need for a systematic safety net to maintain security of supply. -

26 June 2019

Stefan Kapferer becomes CEO of 50Hertz

As joint shareholders of 50Hertz, Elia and German investment bank KfW are pleased to announce the appointment of Stefan Kapferer as the new CEO of the German system operator.

-

21 June 2019

Okto Acoustics wins the third edition of the Open Innovation Challenge

The start-up OKTO Acoustics has won the third edition of the Elia Group Open Innovation Challenge of Elia and 50Hertz. -

19 June 2019

Disclosure in accordance with article 15 of the Belgian Act of 2 May 2007

As a result of its EUR 434.8 million rights offering, Elia System Operator NV/SA issued 7,628,104 new shares, as recorded in a notarial deed dated 18 June 2019. -

14 June 2019

92.17% of the new shares subscribed at closing of the subscription period for preferential rights

Elia System Operator SA announces today that 7,030,981 New Shares or 92.17% of the 7,628,104 new shares it offered as part of its rights offering of maximum EUR 435 million, were subscribed at a subscription price of 57 EUR per share, on the basis of 1 new shares for 8 preferential rights. -

14 June 2019

Elia announces successful rights offering - Existing shareholders and new investors have fully subscribed to the rights offering following a successful private placement of the scrips

Elia System Operator SA announces that, after the public offering of new shares to existing shareholders and any holders of an extra-legal preferential right and the successful private placement of scrips, 100% of the new shares offered in the rights offering have been subscribed. -

05 June 2019

Elia System Operator launches a rights offering (with non-statutory preferential subscription rights) of maximum 7,628,104 new shares, for an amount of maximum 434,801,928 EUR

Elia System Operator announces today the launch of a public offering to existing shareholders and any holders of an extra-legal preferential right of 434,801,928 euros maximum, through the issuance of up to 7,628,104 new shares at a subscription price of 57 EUR per share, on the basis of 1 new share for 8 preferential rights. -

21 May 2019

Shareholders’ Meeting approves the 2018 financial results, the dividend pay-out and authorised capital

Today, Elia held its Ordinary and Extraordinary General Meetings of Shareholders. Shareholders approved all items on the agenda. -

17 May 2019

Interim Statement: Q1 2019

On Friday 17 May, the Elia Group published its interim statement for Q1 2019. -

16 May 2019

First plug at sea successfully installed

Today, Federal Minister Philippe De Backer and Minister Marie Christine Marghem visited the Modular Offshore Grid (MOG), the switchyard platform in the North Sea that will soon bundle together cables from offshore wind farms and connect them to the mainland. -

30 April 2019

Elia's Federal Development Plan 2020-2030 approved

Elia's Federal Development Plan 2020-2030 has been approved by Federal Energy Minister Marie Christine Marghem. -

30 April 2019

Elia appointed Belgian system operator until 2042

The draft ministerial decree renewing the appointment of Elia System Operator SA/NV as the operator of Belgium's electricity grid was passed on Friday 26 April. -

08 April 2019

Elia contemplates to update organisation

Elia contemplates to implement an internal reorganization project aiming at isolating and ring-fencing the Belgian regulated activities of Elia from its non-regulated activities. -

26 March 2019

Disclosure in accordance with section 15 of the Belgian Act of 2 May 2007

Because of the implementation of the capital increase in favor of the members of the personnel of Elia System Operator NV/SA and its Belgian subsidiaries, as recorded in a notarial deed dated 22 March 2019, Elia System Operator NV/SA has issued 9.776 new shares. -

22 February 2019

Elia Group full year 2018 results

Strengthening our position in 50Hertz while progressing well in key investments -

19 February 2019

Elia and 50Hertz call for start-ups to compete for their third Open Innovation Challenge

With the third Open Innovation Challenge, Elia Group calls for ideas from start-ups across the world to improve the day-to-day operations of its two electricity transmission companies: Elia in Belgium and 50Hertz in Germany. -

18 January 2019

Disclosure in accordance with section 15 of the Belgian Act of 2 May 2007

As a result of the implementation of the capital increase in favour of the members of the personnel of Elia System Operator NV/SA and its Belgian subsidiaries, as recorded in a notarial deed dated 20 December 2018, Elia System Operator NV/SA has issued 114.039 new shares. -

11 January 2019

2020-2023 tariff methodology: Elia takes note of the Markets Court ruling

Electricity transmission system operator Elia had lodged an appeal against the provision of the CREG’s tariff methodology 2020-2023, regarding the impact on regulated tariffs of loans contracted to finance non-regulated activities. -

08 January 2019

Elia successfully completes €500 million bond offering

Elia System Operator NV/SA (“Elia”), the Belgian transmission system operator, has successfully launched a €500 million Eurobond under its €5 billion EMTN programme. -

30 November 2018

Interim Statement: Q3 2018

Highlights:

Elia successfully completes long-term financing for the acquisition of an additional 20% stake in Eurogrid. -

28 August 2018

Elia successfully completes long term financing for the acquisition of an additional 20% stake of Eurogrid

Today, Elia System Operator SA/NV ('Elia') successfully launched a EUR 300 million 10-year senior bond and EUR 700 million perpetual hybrid to refinance a bridge loan for the acquisition of an additional 20% stake in Eurogrid International SCRL (‘Eurogrid’). -

22 August 2018

Elia welcomes German Bank KfW as shareholder in transmission system operator 50Hertz

Elia System Operator SA/NV (‘Elia’) announces the closing of the transactions with IFM Global Infrastructure Fund (‘IFM’) and the German state-owned bank Kreditanstalt für Wiederaufbau (‘KfW’) regarding a 20% stake in Eurogrid International (‘Eurogrid’). -

27 July 2018

Half Year Results 2018 Elia Group: Consolidating our position in 50Hertz while delivering solid operational performance

HIGHLIGHTS :

Grid investments of €234 million in Belgium and €104 million in Germany to ensure reliable supply of electricity and accommodate growing renewable energy flows. -

27 July 2018

Elia to partner with Bank KfW as shareholder in German transmission system operator 50Hertz

Elia exercises its pre-emption right on the remaining 20% stake in Eurogrid held by IFM and will immediately sell the stake at the same price to German state-owned bank Kreditanstalt für Wiederaufbau (KfW).

The transaction between Elia and KfW fosters Belgian-German cooperation regarding critical grid infrastructure. -

28 May 2018

Elia receives notification from IFM that it intends to sell remaining 20% in Eurogrid, the holding company above German transmission system operator 50Hertz

The Belgian transmission system operator (TSO) Elia System Operator SA/NV (‘Elia’) has received a notification from IFM Global Infrastructure Fund (‘IFM’) that it intends to sell its remaining 20% share in Eurogrid International (‘Eurogrid’), the holding company of the German TSO 50Hertz Transmission GmbH (‘50Hertz’). -

16 May 2018

Interim Statement: Q1 2018

On Wednesday 16 May, the Elia Group published its interim statement for Q1 2018. -

26 April 2018

Elia completes the acquisition of an additional 20% in 50Hertz

Elia System Operator SA/NV (‘Elia’), the Belgian transmission system operator (TSO), announced today that it has completed the acquisition of an additional 20% stake in Eurogrid International SCRL (‘Eurogrid’), the holding company of the German TSO 50Hertz Transmission GmbH (‘50Hertz’). -

23 March 2018

Elia has decided to acquire an additional 20% stake in German transmission system operator 50Hertz

Elia has decided to exercise its pre-emption right and to increase its share in Eurogrid, the holding company above 50Hertz, from 60% to 80%. -

23 February 2018

Elia Group annual results 2017

Elia Group strengthens and expands electrical grid while delivering a strong financial performance.